The ECB’s announcement that it may still buy Greek government bonds until the end of 2024 reduces the risk of sharply higher sovereign borrowing costs as the Pandemic Emergency Purchase Program (PEPP) winds down, Fitch Ratings says.

The ECB confirmed on Thursday that PEPP net asset purchases will cease from end-March 2022, but extended the period for reinvesting maturing bonds by one year to end-2024. The ECB also said that, during possible pandemic-related market stresses, PEPP reinvestments “can be adjusted flexibly across time, types of assets and jurisdictions” including purchasing Greek bonds “over and above rollovers of redemptions”.

The PEPP has been an important source of financing flexibility for Greece, whose government bonds are ineligible for other ECB purchase programmes due to their sub-investment-grade status. By end-November the ECB had bought EUR34.9 billion (19.3% of forecast 2021 GDP) of Greek government bonds, close to the amount implied by the EUR1.85 trillion PEPP envelope and Greece’s ECB capital share of around 2%.

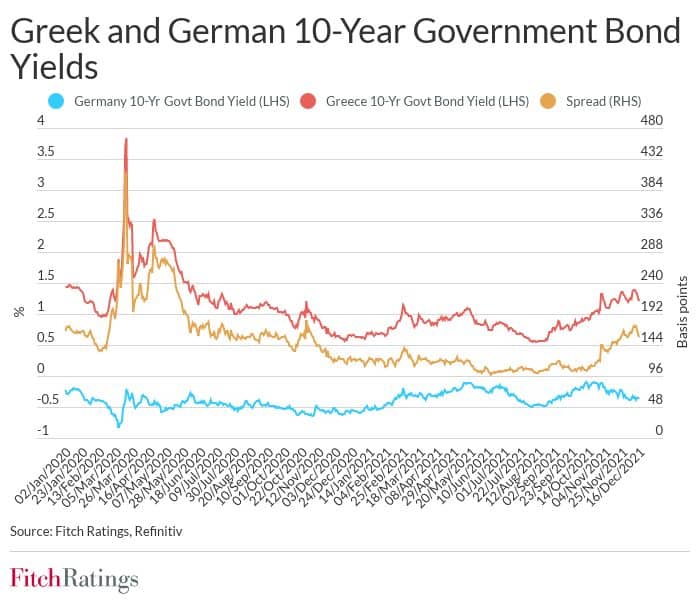

PEPP purchases have helped keep down marginal interest rates on Greek debt, with the 10-year yield falling to around 1.3% from over 2% in May 2020. Other factors also support public debt sustainability. Greece’s substantial liquid asset buffer is forecast to be close to 18% of GDP at year-end, which would cover our estimate of 2022 debt service. The concessional nature of most debt means average servicing costs are low (in absolute terms and relative to ratings peers) and amortisation schedules are manageable.

Moreover, the Greek authorities have proactively managed the amortisation schedule. We estimate a recent liability management exercise decreased amortisations for 2023–2025 by around EUR1.1 billion (0.5% of forecast 2023 GDP). The average maturity of Greek debt is among the longest of any sovereign, at around 19 years. Press reports suggest Greece will repay its outstanding IMF loans next year (around EUR1.85 billion). Previously we have estimated that a large, permanent rise in market interest rates would increase the debt ratio, but only by around 4.5pp over five years.

Notwithstanding these mitigants, Greece’s very high public indebtedness is a rating weakness. We estimate government debt-to-GDP in 2021 declined from its 2020 peak of 206.3% of GDP to 197.3%% – still the third-highest among Fitch-rated sovereigns.

Lower deficits and sustained economic growth will support debt reduction. We forecast real GDP growth of 8.3% this year and expect the recovery to continue in 2022 as the deployment of Next Generation EU recovery funds gathers pace and lifts real spending, with growth of 4.1% and 3.6% in 2022 and 2023. But the debt ratio will remain elevated, at just under 188% in 2023.

Fitch also believes the ECB will remain flexible enough to avoid cliff effects for Greek banks’ funding and liquidity. Special conditions under the third series of targeted longer-term refinancing operations (TLTRO-III, about 20% of sector funding) are scheduled to end in June 2022, but the two-tier system for reserve remuneration may be adjusted to reduce funding costs. We also think the ECB could extend the waiver for including Greek government debt as repo collateral beyond June.

Greek banks’ funding and liquidity profiles have structurally improved in recent years, supported by healthy customer deposit growth and better debt market access. Banks have increased unsecured debt issuance to meet upcoming resolution requirements and would be able to increase secured interbank funding as TLTRO-III funding matures, albeit at higher cost.

Our next scheduled review of Greece’s ‘BB’/Stable sovereign rating is on 14 January. Greater confidence in government debt/GDP returning to a firm downward path after the Covid-19 shock, continued asset-quality improvement at systemically important banks, and better medium-term growth potential and performance could lead to positive rating action.

Source: Fitch Ratings