Fiercer competition from other social networking platforms such as TikTok, the huge investments and the risk involved in turning to the so-called metaverse and Apple's new privacy policy on iPhone and other devices are the three main reasons for the shock results and financial forecasts of Meta, which caused the unprecedented fall of its shares on the stock exchange.

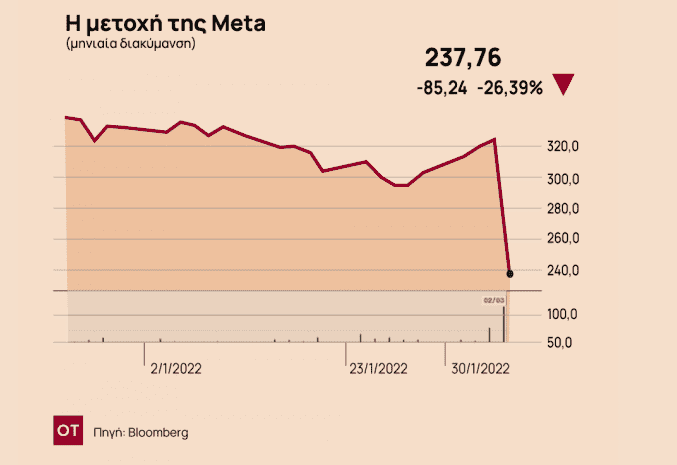

According to Dow Jones Market Data, the stock plunge shaved $232 billion off the company’s market value, which was the largest single-day decline in market value on record for a listed company, even an American one.

That loss of market value is larger than the entire market values of Netflix Inc. NFLX, +1.13%, Advanced Micro Devices Inc. AMD, +2.93% and AT&T Inc. T, -1.95%, among others and is more or less equivalent to the GDP of Greece.

Whilst it still has an attractive financial profile, the main Facebook platform has been losing appeal with younger users, bringing its future into question.

“It’s not a major surprise that core blue is maturing and TikTok is gaining traction among the younger demographic – but following what was one of the roughest Meta conference calls in years, we think investors may start to question whether team Zuckerberg can salvage any growth out of FB, or whether the asset that represents - 2/3rds of revenue is in secular decline mode,” wrote Ross Sandler, Barclays analyst.

The TikTok Factor

Facebook seems to have been surprised by the public’s new penchant, and especially the younger audience, for short videos like the ones that can be sent and received through TikTok, which belongs to the Chinese giant ByteDance.

Zuckerberg’s answer to TikTok is a similar video format called Reels, but the company doesn’t make as much money when users browse the Reels section as it does when users spend time on their main feeds or watching ephemeral “stories” content.

Short videos, however, may be good for engaging users, but they are not as good a platform for attracting advertising revenue as other traditional social media products, with the risk that these users will be spending less time looking at other types of content that Meta more easily monetises.

Apple Privacy Changes

Referring to the company's financial results and prospects for the current year, senior executives of Meta Platforms including CFO Dave Wechner highlighted privacy-related changes by Apple's new privacy policy as having a great impact.

The company implied the changes by Apple may not be impacting all digital-ad players equally.

While the changes require that apps obtain users’ permission before tracking their activity across apps and sites, Apple doesn’t require such prompts for its Safari browser, on which Alphabet Inc.’s GOOG, +0.26%GOOGL, +0.14%Google pays to be the default search engine.

Apple's new policy is expected to cause Meta to lose $10 billion in such ads.

“What that means is that search ads could have access to far more third-party data for measurement and optimization purposes than app-based ad platforms like ours,” said Wehner.

The Results that Caused Concern

Meta said revenue for the first quarter would be $ 27 billion to $ 29 billion, with analysts expecting $ 30.15 billion. It was also announced that the daily active Facebook users worldwide were 1.929 billion in the fourth quarter of 2021, showing a decrease for the first time compared to the previous quarter, when it was 1.93 billion. The company's total fourth-quarter revenue from advertising rose to $ 33.67 billion from $ 28.07 billion in the fourth quarter of 2020. At the same time, the company's expenses almost doubled to $ 21 billion, which led to reduced profitability.

Bernstein’s Mark Shmulik narrowed in on Meta’s light revenue outlook for the first quarter, which came up about $2 billion short of the consensus view at the midpoint.

“Whether you like the company or not, Meta built a reputation of continuous execution and was expected to follow the strong prints of Apple, Microsoft MSFT, +1.56%, and Google, but the company instead delivered an outlook that “feels like a hangover from the digital ad party of the past 18 months, ” said Schmulik.

Shmulik, however, still saw value in Meta shares.

“We get that the story may be too hard for investors to get behind given the lack of buying at these depressed prices, and fixes/answers to these questions take time,” he wrote. “But we continue to believe in the company, and the value investor in us can’t help but look at this price and believe that the risk/reward remains one-sided and we would be buying the stock here.”

Read also Entry into Greece without mandatory test from Monday for those with an active European vax cert