Just how serious Pakistan’s economic woes are reflected in remarks of Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF). She recently said Pakistan had been asked by the IMF “to take steps to be able to function as a country” and not get into a dangerous place where it needs debt restructuring.

The News International, the Pakistan daily, reports(20 February 2023) that IMF chief said, “We are emphasising two things — number one, raising tax revenues, as those who are making good money in public or private sectors, need to contribute to the economy, and, number two, a fairer distribution of precious resources by taking subsidies away from people who don’t need them. It shouldn’t be that the wealthy benefit from subsidies. It should be the poor [who] benefit from them.”

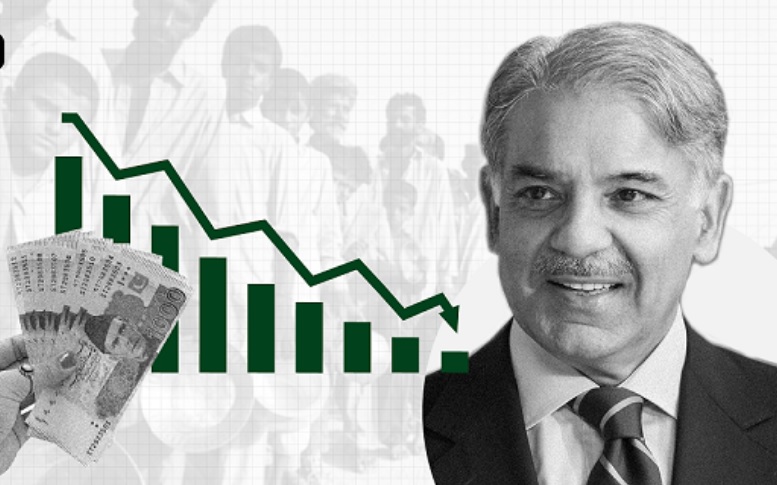

She added that: “We (IMF) want the poor people of Pakistan to be protected.” Consequently, Prime Minister Shahbaz Sharif announced (26 February 2023) a broad range of measures aiming to tighten the government’s belt but warned people to brace for more price hike due to the tough conditions of imposed by the IMF.

Prime Minister Sharif also unveiled the austerity measures approved by the federal cabinet and expressed the hope that the government would be able to take the masses out of the current economic conditions.

The main highlight of the government’s austerity measures was the withdrawal of salaries and perks of the Prime Minister, minister’s special assistants and advisers, along with a 15 per cent cut in the expenses of all government departments. Essentially, the point that PM Sharif made while talking to the media was that rich in Pakistan needed to make sacrifices for the country.

Someone needs to ask the PM as to why the Pakistan Army, which has made “good money” over the years, is not being asked to sacrifice its funds for the betterment of Pakistan. All the lands that army officers own, the factories and industries that they operate, and funds parked in Swiss bank accounts could well be used to improve Pakistan’s economic conditions.

After all, more than 20 per cent of Pakistan’s annual budget goes to the Army. Also, the Army has

its own sources of funding through the numerous legal and illegal business enterprises that it runs and operates across Pakistan! The Army is actually the biggest business conglomerate in Pakistan. It employs nearly three million people and has an annual revenue of over US$26.5 billion.

The current situation sees Pakistan facing multiple challenges in the form of a deep economic crisis, political turmoil, and intensified terror attacks in the north-western areas. All this has drained Pakistan of its resources.

Further, the country’s economic deterioration has a direct impact on the people of Pakistan. Official sources told The News International that the IMF could help Pakistan overcome its looming Balance of Payments (BoP) crisis only by ensuring that the country remains able to pay its debt obligations without plunging into default. Revival of the IMF program is a pre-requisite for seeking any debt restructuring, so the government is focusing on it currently.

It is only after this that debt restructuring, especially from non-Paris Club countries, might be considered. Pakistan will require external debt servicing both in the shape of principal and mark-up amounts to the tune of US$27 billion in the next financial year. The ongoing IMF program of US$6.5 billion under the Extended Fund Facility (EFF) will expire on 30 June 2023 and there is no possibility of any further extension in the ongoing EFF arrangement.

At that stage, Pakistan will have to seek a fresh IMF loan keeping in view the massive

external debt servicing requirements and with the possibility of lower foreign

exchange reserves.

Pakistan’s historic high in petrol price and the IMF’s delay in sending aid are pushing Pakistan’s economy into a ‘tailspin’. Geo News reported that Pakistan had hiked the prices of petrol to Pakistani Rupees Rs 272 per litre to appease the IMF for unlocking the critical loan tranche. Pakistan’s current situation is the most difficult faced by the country in the last two decades, South Asia Press reports.

However, the IMF’s recent review mission has made it clear that the government will have to undertake tax revenues from all those who

possess income to contribute to the national kitty. There are only around 3.5 million return filers out of over 200 million population, so there is a need for broadening of the narrow tax base. Under the IMF’s prescriptions, the government unveiled the minibudget, slapping additional taxes of Pak Rs.170 billion and it was expected that it would soon be passed by the National Assembly.

Secondly, the IMF has underscored the need to remove untargeted subsidies and divert resources from the rich and wealthy towards the poor

segments of the society. Under the IMF program, the government abolished the power sector subsidy for export-oriented sectors and did away with the Kisan package.

Pakistan government has asked the IMF to provide adjuster on flood-related expenditures to the tune of Pak Rs.472 billion and the Fund mission has reportedly agreed to it. For the BISP programme, the government has jacked up allocation from Rs.360 billion to Rs.400 billion for protecting the poorest of the poor from inflationary pressures, which are expected to witness a surge and could cross 35 per cent mark till June 2023 from the existing CPI based inflation standing at 27.6 per cent for January 2023.

Prime Minister Sharif said that taxes had been imposed on large companies, most of which was on luxury goods along with phasing out of certain subsidies on the IMF’s insistence. He warned, however, that the IMF’s demand for reducing subsidies, might engulf the country in a new wave of inflation.

Therefore, Shahbaz said, the subsidies for the poor would be maintained, announcing that the support amount for the poor from the Benazir Income Support Programme was being increased by 25 per cent.

True, the rich in Pakistan need to be taxed. Lest we forget, that includes the Army and its coterie of officers who have amassed wealth while in power. The former Army Chief General Qamar Bajwa and his family have allegedly amassed wealth inside and outside Pakistan worth Pak Rs. 12.7 billion.

Further, every politician in Pakistan, including current PM Shahbaz Sharif and former PM Nawaz Sharif has considerable investments in industry. The IMF needs to think about how to get the accumulated wealth of such persons in Pakistan to be used for the benefit of the people of Pakistan. The odds of this happening are quite low, but efforts in this direction need to happen, even

as Pakistan descends into chaos.