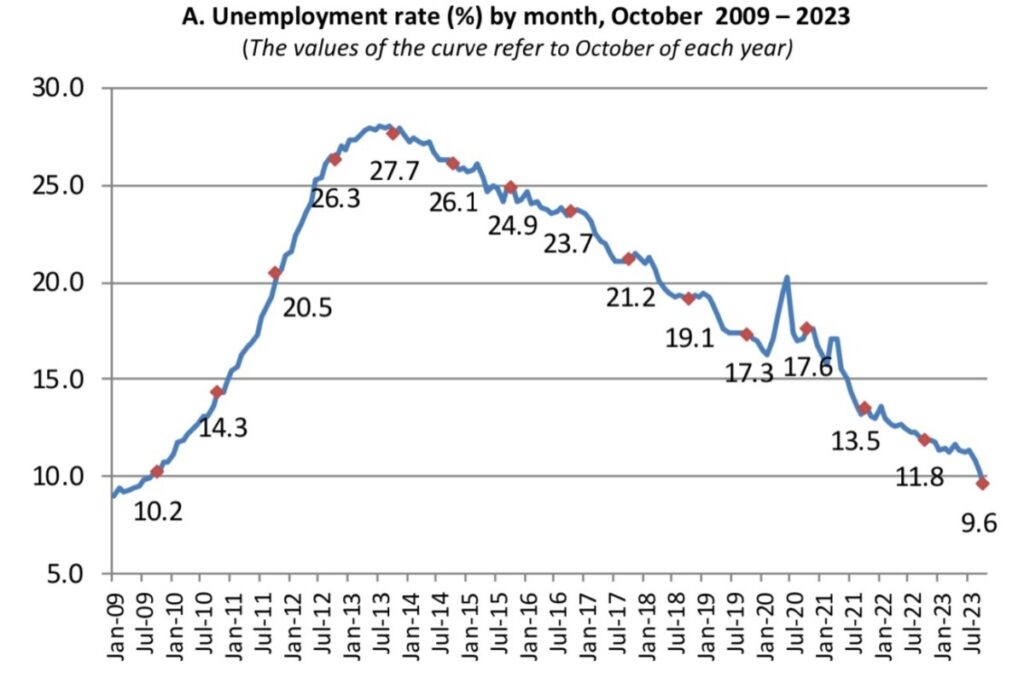

Greek unemployment fell to 9.6% — that’s in SINGLE digits- for the FIRST time since the economic crisis started 14 years ago.

Laden with debt it could not pay back, Greece nearly broke the eurozone a decade ago, but today, it is one of Europe’s fastest-growing economies. In a significant acknowledgment of the country’s turnaround, credit rating agencies have been upgrading their appraisal of Greece’s debt and opening the door for large foreign investors.

The economy is growing at twice the eurozone average, and unemployment dropping to the lowest in well over a decade demonstrates this.

Tourists have returned in droves, fueling a construction frenzy and new jobs. Multinational companies, like Microsoft and Pfizer, are investing. And banks that almost collapsed have cleaned up and are lending again, benefiting the broader economy.

Greece became the center of Europe’s debt crisis after Wall Street imploded in 2008. Ireland, Portugal and Cyprus were also forced to take international bailouts. But Greece had it the worst, requiring three rescue packages from 2010 to 2015, totaling 320 billion euros, or $343 billion, with bitter austerity terms. Household incomes and pensions were slashed.

The economy shrank by a quarter, and hundreds of thousands of businesses collapsed as banks shuttered. By 2013, nearly a third of Greeks were unemployed.

Greece exited the bailout programs’ strict fiscal controls in 2018, and the government’s actions since then have earned confidence from the European Union. In 2021, Brussels policymakers approved another €30 billion for climate investments in Greece, part of a broader effort to bolster EU economies after Covid-19 lockdowns.

In September, DBRS Morningstar, a global credit rating agency recognised by the European Central Bank, raised Greece’s debt rating to investment grade, a move that opens the door for pensions and other big investors to buy bonds issued by the government and for more credit rating agencies to improve Greece's status.

Greek economy to grow by 2.4% this year, 2.0% in 2025, OECD survey

The Greek economy is projected to grow by 2.4% this year and 2% in 2024 rising again to 2.4% in 2025, the OECD said in its economic survey report released on Wednesday. The Paris-based organisation said that Greece’s strong economic rebound from the COVID-19 crisis is being put to the test by surging energy and food prices and renewed global uncertainty.

The survey said that continued policy reforms over recent years have been a key factor behind the country’s robust post-pandemic recovery and have put the economy in a stronger position to face current headwinds.

GDP has returned to pre-pandemic levels, helped by effective government support, a revival in tourism and exports, and improved investor and consumer confidence. Employment growth has been strong, creating over a quarter of a million new jobs since before the start of the pandemic, reducing the unemployment rate to a 12-year low of 11.6%.

To sustain the recovery, the survey recommends to better allocate public spending, strengthen public revenues, improve the functioning of the labour market and keep up efforts to create a more dynamic business sector.

"Greece’s robust and targeted policy response to the COVID-19 pandemic secured a strong and rapid recovery. The government’s ‘Greece 2.0’ recovery plan is already laying the strong foundations for Greece’s ability to tackle future challenges," OECD Secretary-General Mathias Cormann said, presenting the Survey.

"Ensuring the ambitious reform and investment agenda is fully implemented will help to further improve opportunities for businesses and households and will be essential for the Greek economy to navigate past the current headwinds towards a path of sustainable growth."

"Structural reforms are the key to continued economic and social progress," the Survey says, "as high energy and other key commodity prices, especially since Russia’s war of aggression against Ukraine, are slowing Greece’s recovery. Inflation peaked at 12.1% in October 2022 - its highest rates in 25 years - which is weakening demand, delaying investment and setting back recent gains in purchasing power for households. GDP growth is expected to moderate from 5.1% in 2022 to near 1% in 2023 and recover to approach 2% in 2024. To buffer the inflation shock, the government has expanded energy and fuel price subsidies. This has, however, delayed the return of the primary budget surplus to its medium-term target of 1.5% to 2% of GDP, which weighs on Greece’s ability to access less expensive financing for investment. While reducing high rates of poverty, the Greek economy still leaves many people behind, the Survey says. The share of youth in work lags other OECD countries, despite recent improvements. Legal reforms are improving gender equality but, in practice, and despite progress, relatively few women earn an income from work. Greece benefits less than it could from the skills of its foreign-born workforce, even as employers across a growing number of sectors report increasing difficulties recruiting staff," the survey noted.

It added that the government’s ‘Greece 2.0’ reform and investment plan for 2021-26 aims to address many of the economic challenges facing the country, and it also set out set out a number of recommendations to help sustain the recovery, raise incomes, and achieve the transition to a net-zero emission economy.

Greek budget showed a primary surplus of 6.08 billion euros in Jan-Oct

The Greek state budget recorded a primary surplus of 6.08 billion euros in the January-October period, up from a budget target for a surplus of 5.607 billion and a primary deficit of 350 million euros in the corresponding period last year, the Finance ministry said in a report on budget execution in an amended cash basis.

More specifically, net revenue totaled 53.925 billion euros, up 49 million from targets, while regular budget revenue was 59.474 billion, up 49 million from targets. Tax revenue was 50.718 billion, up 33 million from targets reflecting a 2.0 million euros increase in VAT revenue to 19.585 billion, an 8.0 million euros rise in special consumption tax revenue to 5.806 billion, a 1.0 million euros rise in property tax revenue to 2.235 billion and a 15 million increase in income tax revenue to 16.934 billion euros.

Social contribution revenue totaled 48 million, transfer revenue was 5.098 billion euros, up 4.0 million from targets, selling of goods and services totaled 734 million euros, up 7.0 million from targets and other revenue totaled 2.871 billion.

Tax returns totaled 5.55 billion euros, while Public Investment Programme revenue was 2.81 billion, up 2.0 million from targets.

Budget spending totaled 54.406 billion euros in the 10-month period, down 430 million from targets, but up 767 million from the same period last year, reflecting higher interest payments. Regular budget spending was down 464 million from targets. Public Investment Programme payments totaled 7.73 billion euros, up 34 million from targets.

In October, budget revenue was 5.628 billion euros, while regular budget revenue was 6.193 billion. Tax returns totaled 564 million euros and Public Investment Programme revenue was 109 million.

READ MORE: The 4 reasons why foreigners want to buy holiday homes in Greece.