Founder of streaming group Spotify Daniel Ek will channel €1bn over the next decade into early stage ‘moonshots’ i.e. companies working on ambitious, exploratory and ground-breaking solutions with little chance of near-term profitability thus too early for most venture capital firms.

“We all know that one of the greatest challenges is access to capital. And that is why I’m sharing today that I will devote €1bn of my personal resources to enable the ecosystem of builders,” Ek said speaking at Slush, a technology conference.

Machine learning, biotechnology and materials science were named as sectors of interest.

Ek believes that Europe needs more super companies to raise the bar and act as inspiration.

“If you compare Europe versus the US, we’re still, by an order of two or three, underfunding for each and every stage in Europe compared to American (venture capital) companies,” Mr Ek said.

According to CB insights data, European start-ups raised $7.3bn in 843 deals in the second quarter.

Asian companies raised almost double this total, while US start-ups almost quadrupled the amount of funding. Some US venture capital firms, such as Sequoia Capital, have recently begun to form investment teams in Europe, where start-up valuations have for the most part been lower compared with the US and Asia.

It upsets Ek, who managed to keep Spotify from being acquired before going public in 2018, that so many European founders receive advice to sell their start up.

“I get really frustrated when I see European entrepreneurs giving up on their amazing visions selling early on to non-European companies, or when some of the most promising tech talent in Europe leaves because they don’t feel valued here,” he added.

Europe has created tech groups such as Spotify and Skype, but has trailed the US and China, which have bred giants including Alibaba, Amazon and Apple. Europe’s more regulated market and a lack of funding have been blamed by some for the gap.

“I want to do my part; we all know that one of the greatest challenges is access to capital,” Ek said, adding he wanted to achieve a “new European dream”.

He sees this European dream as being more focused on building a ‘better future for the collective, not just the individual’, which is the concept at the heart of the American dream.

Mr Ek argued that the cultural differences between Europe and the US could be an asset in carving out innovation for “collective welfare”.

“Europe needs more super companies, both for the ecosystem to develop and thrive. But I think more importantly if we’re going to have any chance to tackle the infinitely complex problems that our societies are dealing with at the moment, we need different stakeholders, including companies, governments, academic institutions, non-profits and investors of all kinds to work together.”

According to Forbes, the 37 year old Swede is worth $3.6 billion, suggesting he is willing to devote roughly a third of his own wealth to the investments.

He has previously made small investments in start-ups including Kry, a Swedish telemedicine company, the UK housing website Student.com, and an artificial intelligence company called HJN Sverige.

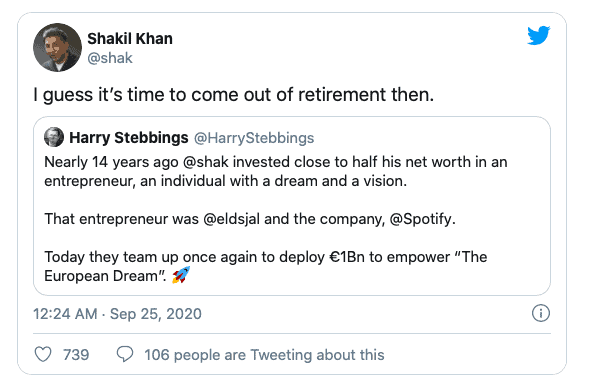

The cash looks to be deployed with the help of close confidant and one of the initial investors in Spotify, Shakil Khan. Ek retweeted one of Khan’s posts which said ‘it’s time to come out of retirement then.’

READ MORE ON GREEK CITY TIMES

Greece announces new €10 billion package to boost coronavirus hit economy