By Greek City Times Newsroom German Chancellor Friedrich Merz has sparked controversy after urging Germans…

Tag: Eurozone

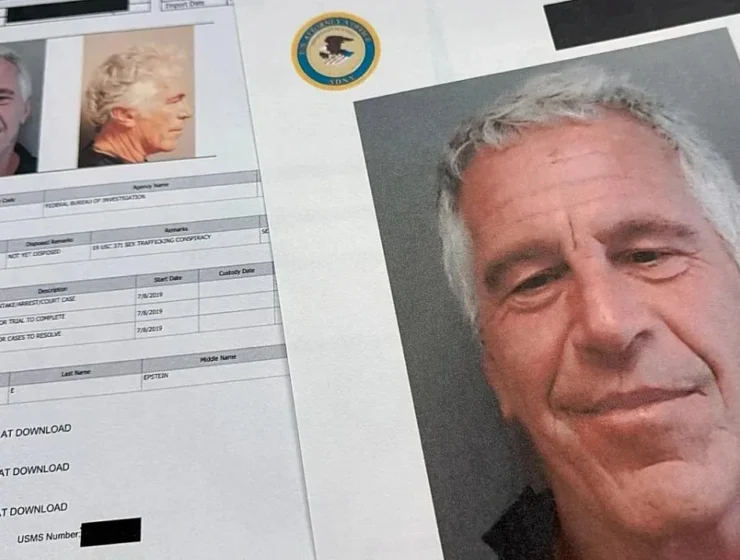

An alleged decade-old email in the Epstein Files claims Greeks paid northern banks for debts they never incurred, spotlighting bailout flows to German and French institutions.

The Greek government successfully completed its first market outing of the year with the issuance…

Greece recorded a primary budget surplus exceeding targets in 2025, highlighting the country’s strong fiscal…

Greece has emerged as one of the cheapest countries in the Eurozone for mortgage loans,…

Bulgaria has officially adopted the euro, becoming the 21st country to join the eurozone, nearly…

Greece recorded economic growth rates in 2025 that were significantly higher than the eurozone average,…

The Bank of Greece (BoG) has reported a robust expansion in credit activity across the…

Bulgaria is set to become the 21st member of the eurozone in just 10 days,…

The ECB has shortlisted motifs for new euro banknotes featuring iconic Europeans like Maria Callas and Marie Curie under the “European Culture” theme, or birds and rivers for nature-focused designs, with final selection in 2026.

Greek Minister of National Economy and Finance Kyriakos Pierrakakis declared that his election as president…

Greece celebrates a historic milestone with the election of Minister of National Economy and Finance,…

European Council President António Costa and European Commission President Ursula von der Leyen extended their…

The European Commission has issued a positive assessment of Greece’s draft budgetary plan for 2026…

The European Central Bank (ECB) expects the first transactions using a digital euro to take…

Morgan Stanley forecasts Greece will remain one of the eurozone’s fastest-growing economies through 2027, with steady 2% GDP growth, rapidly falling public debt, and strong domestic demand driven by wage hikes and RRF-funded investments.

The ECB has approved the next phase of the digital euro, targeting a 2027 pilot if EU legislation passes soon, with full issuance possible by 2029. Christine Lagarde stressed modernizing Europe’s currency while preserving privacy, choice, and monetary sovereignty. The €1.3 billion project aims to complement cash, boost innovation, and ensure competitive digital payments across the eurozone, including Greece.

Bank of Greece Governor Yannis Stournaras forecasts an “investment boom” that will raise investments to…

The International Monetary Fund (IMF) has projected that the Greek economy will grow by 2%…

The Athens Stock Exchange (ATHEX) has officially been upgraded by global index provider FTSE Russell…

Moody’s delivers its long-awaited verdict on Greece’s credit rating today, with analysts bracing for no upgrade amid cooling growth and stubborn inflation. Fresh off DBRS’s decision to hold steady, the US agency’s review spotlights a new €1.6bn tax package hailed as “credit positive” for tackling demographic woes – from a fertility rate of just 1.3 to a projected 61% elderly dependency by 2040. Yet, as Q2 GDP dips to 1.7%, doubts linger: Can fiscal perks reverse brain drain and sustain momentum post-EU recovery funds?

Greece faces one of the highest inflation rates in the Eurozone at 3.7% in July, up from 3.6% in June, prompting concern from the Prime Minister. While consumer prices dipped 0.3% monthly, Greeks are experiencing sharper price increases than the European average, with food and alcohol prices rising fastest at 3.3%.

Despite recent wage hikes, Greece lags far behind the EU average, with salaries rising only 7% from 2018 to 2023 compared to the EU’s 19%, according to a new KEPE study. With an average annual salary of €17,000, Greece ranks third from the bottom among EU nations, highlighting a stark divide between northern and southern Europe. Stagnant productivity and declining real wages have widened income inequality, with profits now claiming 50.2% of Greece’s GDP, far above the EU’s 41%.

Greek stocks are leading global markets in 2025, with the Athens Stock Exchange posting the highest returns worldwide amid renewed investor confidence, rising foreign inflows, and a proposed takeover by Euronext. Despite global trade tensions and tariff uncertainty, Greece’s investment-grade status, strong economic recovery, and favorable market conditions have positioned it as a standout performer in the eurozone.

Greece’s economy is set to continue outpacing the eurozone average, with the European Commission forecasting steady GDP growth of 2.3% in 2025 and 2.2% in 2026. Driven by strong consumption and EU-funded investment, the country also sees declining unemployment and falling public debt, despite global economic uncertainties.

Greece plans to repay its first bailout loans by 2031—ten years early—easing future debt pressures and highlighting its strong fiscal rebound, Finance Minister Kyriakos Pierrakakis announced.

Despite looming U.S. tariff concerns, American tourists are flocking to Greece in unprecedented numbers this summer, with 103 weekly direct flights scheduled—a 21-flight increase from last year. The Greek tourism industry is buzzing with optimism as U.S. travelers, undeterred by economic uncertainty, prioritize the allure of Greece’s islands and ancient sites. “American travelers are resilient,” says MMGY Global CEO Katie Briscoe, with 83% planning leisure trips in the next year. While long-term tariff impacts worry economists, Greece is set for a historic season of sun-soaked escapes.

Greece’s Economy and Finance Ministry has detailed a €1 billion support package aimed at easing the burden on low-income pensioners and renters, following Prime Minister Kyriakos Mitsotakis’ announcement. The measures include rent rebates, annual pension supplements, and a major boost to public investment, made possible by the country’s strong fiscal performance and return to a primary surplus.

Greece is poised to repay its first bailout loans a decade early, targeting full clearance by 2031, government officials revealed. With annual €5 billion installments, the nation aims to shed its status as the EU’s most indebted country, leveraging a €37 billion cash reserve and robust fiscal gains. Finance Minister Kyriakos Pierrakakis called the plan “realistic,” signaling Greece’s steady recovery from the 2009-2018 debt crisis that nearly upended the eurozone.

European Central Bank policymaker Yannis Stournaras warned that rising inflation driven by U.S. tariffs could delay the ECB’s plans to normalize monetary policy. While Greece may face limited direct impact, broader global trade disruptions could affect exports and investor confidence.