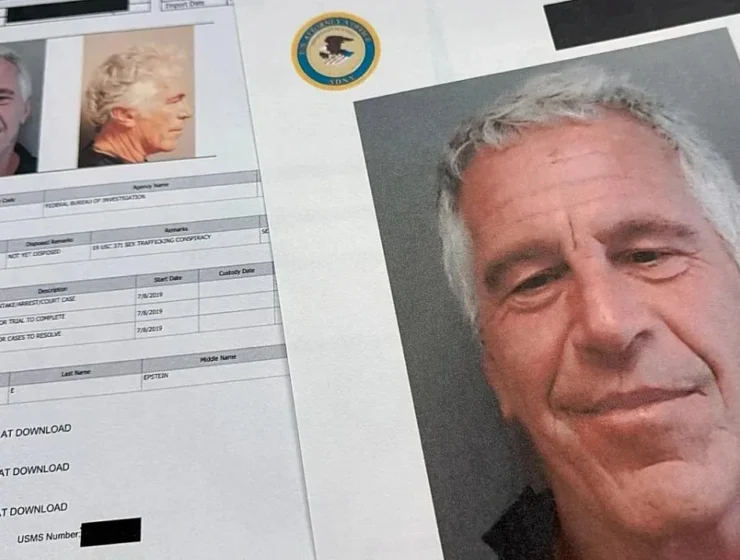

An alleged decade-old email in the Epstein Files claims Greeks paid northern banks for debts they never incurred, spotlighting bailout flows to German and French institutions.

Tag: IMF

The International Monetary Fund (IMF) has projected that the Greek economy will grow by 2%…

The head of the world’s largest bank has issued one of his most alarming forecasts yet, warning that investors are underestimating the risk of a severe stock market correction and suggesting the global financial system is heading towards a “once-in-a-generation reset.”

Canadian rating agency Morningstar DBRS has maintained Greece’s credit rating at BBB with a stable outlook, citing strong growth, steady debt reduction, and political commitment to fiscal discipline, while warning of external risks.

Greece’s judicial system ranks as the slowest in the EU, with civil and commercial cases taking over three years to resolve, according to a new IMF report. The delays are seen as a major barrier to economic growth and legal certainty, prompting calls for urgent reforms including specialized courts, digitization, and streamlined procedures.

IMF Managing Director Kristalina Georgieva praised Greece’s economic transformation during a meeting with Finance Minister Kyriakos Pierrakakis, calling the country a model for global progress. Highlighting strong growth, fiscal discipline, and digital reforms, Georgieva said Greece has become one of the EU’s best-performing economies.

Greece is poised to repay its first bailout loans a decade early, targeting full clearance by 2031, government officials revealed. With annual €5 billion installments, the nation aims to shed its status as the EU’s most indebted country, leveraging a €37 billion cash reserve and robust fiscal gains. Finance Minister Kyriakos Pierrakakis called the plan “realistic,” signaling Greece’s steady recovery from the 2009-2018 debt crisis that nearly upended the eurozone.

Greece will repay €5 billion in eurozone bailout loans by 2025, continuing its early repayment efforts as the economy recovers from its debt crisis. Prime Minister Kyriakos Mitsotakis also criticised the wide energy price disparities within the EU, calling the current market framework “unacceptable” and urging the creation of a bloc-wide energy regulator.

The German newspaper Handelsblatt reports that Greece has made significant progress in reducing public debt, with the government planning an early €8 billion repayment to creditors this December. Economy and Finance Minister Kostis Hatzidakis announced that this payment aims to further decrease the debt ratio, which has fallen from 209% of GDP in 2020 to 163.9% in 2023. Forecasts from the IMF and credit rating agency Scope suggest that Greece’s public debt could drop to 139.4% and 132.8% of GDP, respectively, by 2029.

Greek National Economy and Finance Minister Kostis Hatzidakis will attend the annual IMF and World Bank meetings in Washington this week. He will participate in key discussions on climate action, the global economy, and Ukraine. Hatzidakis will also hold talks with IMF Managing Director Kristalina Georgieva and meet with top investment and banking leaders.

Greece has raised €9.1 billion from financial markets in 2024, nearing 91% of its annual loan program target. With a borrowing plan of €7 billion to €10 billion, the country is taking advantage of favorable market conditions. The International Monetary Fund projects Greece’s public debt will decline to 138% of GDP by 2029.

The International Monetary Fund (IMF) forecasts a primary surplus of 2.1 percent of GDP for…

Greece’s economic prospects have improved significantly, the International Monetary Fund says in its latest assessment…

According to the International Monetary Fund (IMF), Greece’s economy is expected to grow by 2.5%…

Until five years ago and for a decade, the International Monetary Fund (IMF) devastated the…

Growth rates for the Greek economy of 2.5% this year and 2% in 2024 are…

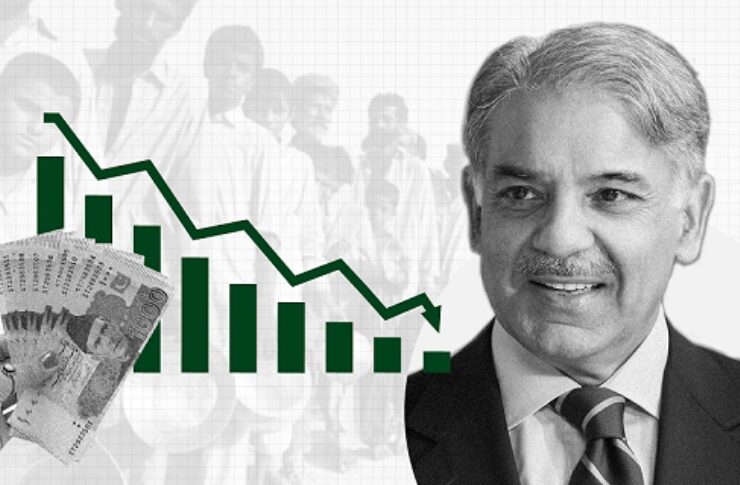

Just how serious Pakistan’s economic woes are reflected in remarks of Kristalina Georgieva, Managing Director…

The slowdown in growth and inflation will be, according to the forecasts of international organisations…

Greece will return to primary surpluses from 2023 and remain on a course of reducing…

Pakistan’s minister of state for Finance and Revenue Aisha Ghous Pasha said that the country…

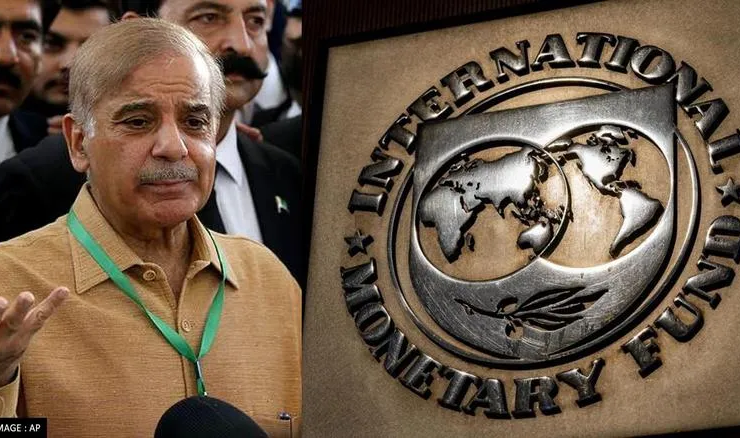

The International Monetary Fund (IMF) is reportedly planning to forbid Pakistan from seeking additional loans…

Greece has weathered the pandemic well, with a considerably stronger-than-expected recovery, which has also seen…

There were concerns that Pakistan’s new budget and plan to trim its deficit by cutting…

Pakistan and the International Monetary Fund (IMF) have yet to reach an agreement on the…

Pakistan’s finance minister said countries that have typically been generous in lending to the crisis-hit…

Greek Prime Minister Kyriakos Mitsotakis announced that the International Monetary Fund (IMF) is no longer…

Greek Finance Minister Christos Staikouras announced on Monday that Greece completed its repayment of its…

The Greek economy is expected to grow by 3.5% this year despite the war in…

Greece will repay the final tranches of bailout loans owed to the International Monetary Fund…

Greece is reportedly planning to repay more than 7 billions euros remaining debt to the…