Prestigious Australian publication The Financial Review (AFR) has released their annual “Rich List” and eight Greeks are listed amongst the wealthiest 200 people in Australia for 2020. Ranking top spot amongst the Greeks and coming in at 79th place is Nick Politis, whose fortune is estimated at 1.31 billion dollars.

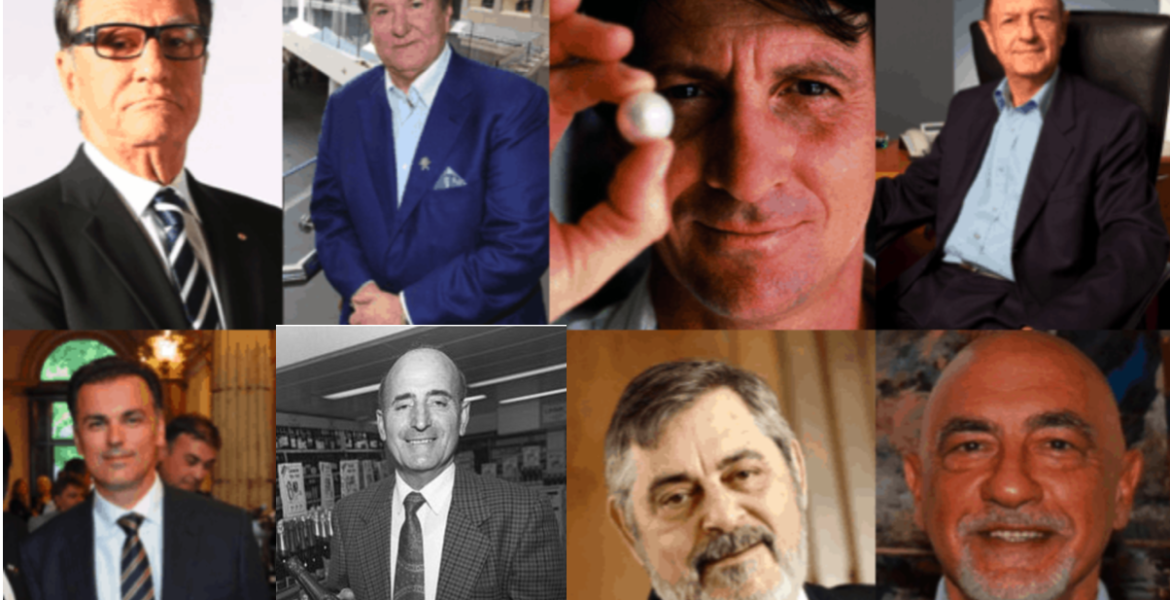

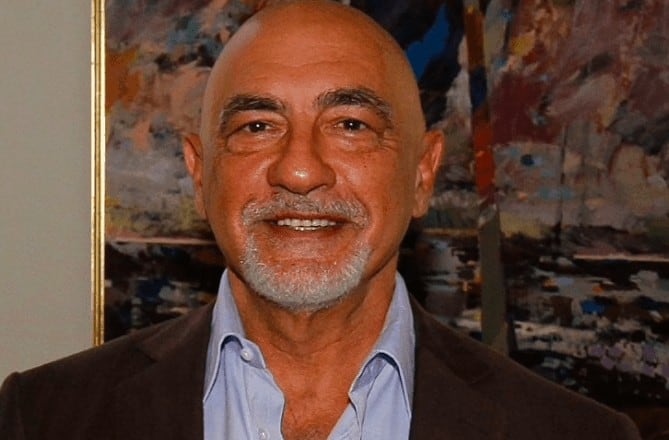

79th place: Nick Politis (1.31 billion dollars)

“It was quite a wealth journey for car king Politis this year, with the pandemic halving new car sales in March before a rebound in June, when luxury car sales boomed as locked-up citizens splashed out. The majority of Politis’ wealth is derived from his 38 privately owned car dealerships and a major holding in ASX-listed auto retailer A.P Eagers, which saw its share price whipsaw from $2.50 in March to $9.20 in August. Politis is a major rugby league powerbroker. The Sydney Roosters chairman offloaded a chunk of shares in the listed Brisbane Broncos, which sank to a $10.2 million loss in the six months to June 30.”

82nd place: Con Makris & family (1.25 billion dollars)

“Makris arrived in Adelaide from Greece as a teenager in 1964 and built a vast property development and shopping centre empire that began with a barbecued chicken shop. Makris stepped back from the day-to-day operations of the Makris Group several years ago and put in place an independent advisory board to guide expansion, which has been focused on Queensland. He put two high-profile Adelaide retail assets on the market in July – Rundle Mall’s blue-chip City Cross shopping centre and the North Adelaide Village neighbourhood shopping complex worth a combined $200 million. Makris became a billionaire in 2015.”

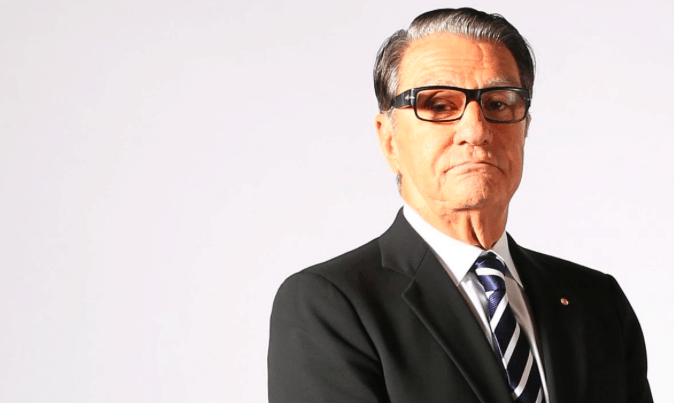

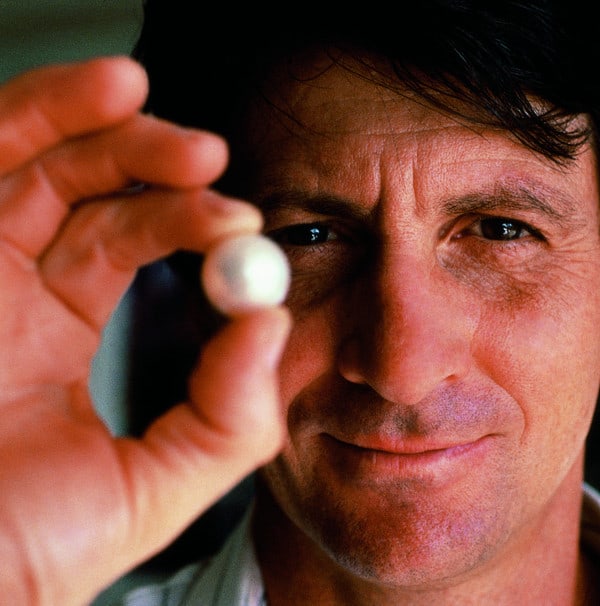

83rd place: Nicholas Paspaley & family (1.25 billion dollars)

“Vogue Australia has listed Paspaley as one of five brands coveted by Meghan Markle, the Duchess of Sussex, igniting more interest in the brand. Pearls now account for less than half the revenue in the broader Paspaley Group, which has interests in livestock, a fleet of planes and property. The pearling company was founded by the late Nicholas Paspaley snr, who fled the Greek island of Kastellorizo in World War I and settled on the West Australian coast. Working in Port Hedland and Broome, he purchased his own pearl lugger by the age of 21. His three children – Nicholas Paspaley jnr; Roslynne Bracher and Marilynne Paspaley – now own the company.”

124th place: Spiros Alysandratos (798 million dollars)

“Consolidated Travel, which Spiros Alysandratos founded in 1967 after emigrating to Melbourne from the Greek isle of Kefalonia, is one of 1500 or so private companies exempted from having to lodge financial accounts. But when your business is selling airline ticketing technology to travel agents, in 2020 there is nowhere to hide. IBISWorld estimates Consolidated Travel’s revenue fell 16 per cent to $1.25 billion in 2019-20. Alysandratos is bearish on the travel sector, declining to participate in a capital raising for travel company Helloworld Travel and selling shares, which saw his stake fall to 13.76 per cent between May and July.”

126th place: Harry Stamoulis & family (793 million dollars)

“The Stamoulis Property Group came into its own when the late Spiros Stamoulis sold his Gold Medal soft-drink brand to Cadbury-Schweppes in 2004. The company is now overseen by his son Harry, with major acquisitions including the $91 million Woolworths distribution facility in the Melbourne suburb of Mulgrave and the $125 million One Collins Street tower in the CBD. Harry’s sister Melina oversees the family-owned Nafsika Stamoulis Hellenic Museum. A passionate soccer fan, having served as a director of Melbourne Victory, Harry remains involved in a venture to bring an A-League team to Tasmania.”

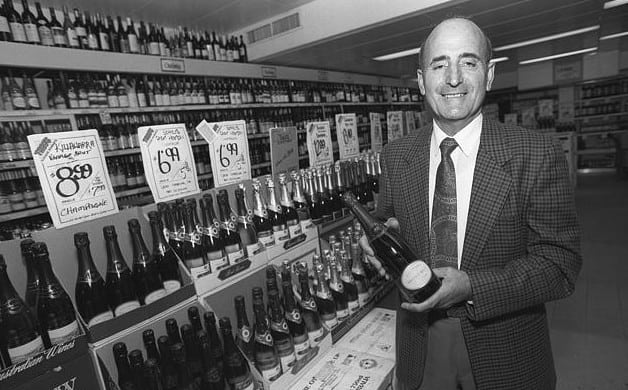

131st place: Theo Karedis (775 million dollars)

“The website of Theo Karedis’ Arkadia Property Services still carries its pre-pandemic self-assessment of the worth of its 25 properties: $900 million. Given half of them are malls or large-format neighbourhood centres, it remains to be seen how much value has been permanently chopped off by e-commerce. Arkadia was founded by Karedis after the $175 million sale of his Theo’s Liquor bottle shops to Coles in 2002, following a bidding war with Woolworths. Karedis migrated from the Greek island of Kythira, opening a deli in Sydney’s Neutral Bay in 1955. He applied for his first in-store liquor licence in 1979.”

146th place: George Koukis (715 million dollars)

“Banking software is not sexy but it’s made a fortune for George Koukis, who migrated from Greece in 1971 with $140 to his name. He got a job as a Qantas “office boy” in 1973, and his break came when he volunteered to computerise the airline’s managed accounting system. In 1993, he paid $948,000 for a small Swiss banking software maker, renamed it Temenos, and built it up with the help of venture capital to a 2001 float at a $2.1 billion valuation. Koukis has gradually sold off his holding to below 3 per cent. He left the board in April. His eponymous aviation software business claims more than 100 installations worldwide.”

154th place: Kerry Harmanis (690 million dollars)

“Kerry Harmanis wasted little time in his return to public life since selling Jubilee Mines to resources giant Xstrata for $500 million in 2007. The long-time investor in gold explorer Talisman Mining became its chairman in July. By September a new CEO was in the chair and corporate costs cut. Talisman shares have been flat over the past year despite a roaring gold sector. It’s a different story for Harmanis’ investment in Capricorn Metals, which is developing a gold project in WA. Its shares have doubled this year. Harmanis, a meditation devotee, set up Mindful Meditation Australia which sells workshops to businesses and schools.”

How the Rich List is calculated

This is the 38th Financial Review Rich List.

The valuations are undertaken by the Rich List editors and an analyst and are minimum estimates. They are calculated using publicly available data and confidential consultation with the list members. Listed company valuations are calculated in the first week of September.