House hunters rejoice! In Tuesday night's Federal Budget, the Morrison government announced increased support for first home buyers. The scheme will provide a significant boost to those struggling to buy their first homes. Cracking into the property market is certainly no easy task, especially during a time of so much global uncertainty.

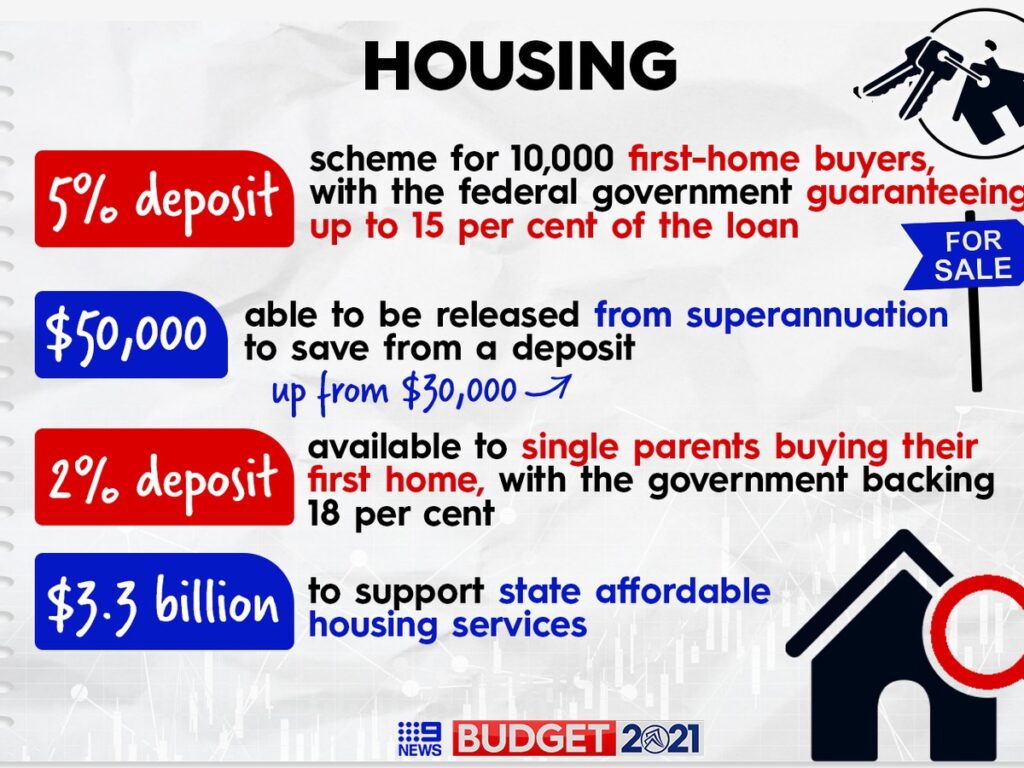

On Tuesday night, National Treasurer Josh Frydenberg affirmed that another 10,000 first home buyers would be able to build a new home with only a 5 per cent deposit and that a further 10,000 single parents will be eligible to buy a home with just a 2 per cent deposit!

The government has also improved the current system that allows Australians to save for their deposit at a lower tax rate via their super fund, with first home buyers now able to keep up to $50,000.

Heres how it'll play out:

- The 'FIRST HOME SUPER SAVER SCHEME'

This scheme works by allowing Australians to boost their savings by stashing money into their superannuation funds.

The system is designed to permit 'prospective buyers to put an extra $15,000 into their super each year.' This will help them save faster for their house deposit because the 'savings attract a 30 per cent reduction in the effective tax rate.'

Under this scheme, from the first of July of 2022, the government will raise the amount Aussies can freely add to their super account from $30,000 to $50,000.

When they find a property they'd like to purchase, the money 'will then be released from the super fund at the lowest tax rate.'

The conditions are as follows: you must live in the home you purchase for at least six months to be eligible.

You may only withdraw extra super contributions you make, not the monthly or weekly contributions made by your employer.

You have 12 months from the date you withdrew the money to when you notify the Australian Taxation Office of your signed contract of purchase.

If this scheme interests you, contact your employer or super fund to obtain information on how to start making voluntary contributions.

- The NEW HOME GUARANTEE scheme:

The government is also providing 10,000 new locations over the next twelve months for first home buyers to either buy or build a new home with only a 5 per cent deposit.

If this applies to you, you may apply for the guarantee (previously known as the First Home Loan Deposit Scheme) via your trusted Financial Institution. Visit the National Housing Finance and Investment Corporation for more information.

- Lastly, the FAMILY HOME GUARANTEE scheme:

If you are a single parent and earn under $125,000 a year, you're in luck!

The new proposal in Tuesday’s budget is the Family Home Guarantee. This will enable single parents with dependents to buy a home with a deposit of as little as 2 per cent.

This is how it would work: A single dad with two children would only be required to save up $10,000. The government guarantees the remaining 18 per cent of the loan, thus allowing the buyer to avoid hefty lender’s mortgage insurance.

The system will only be available to the first 10,000 single parents over the next four years and is not limited to first home buyers. However, it is subjected to the 'individual’s ability to pay back the loan.'

Treasurer Josh Frydenberg announced in parliament that "under the Coalition, homeownership will always be supported".

These measures will be welcomed by those struggling to buy their first home, especially during the Pandemic and how much property prices have been increasing. It really gives millennials some hope! Read more here.