The Greek economy remained resilient through multiple crises and is expected to maintain growth above…

Tag: Greek economy

The Independent Authority for Public Revenue will place the new General Directorate of Economic Transaction Control…

Prime Minister Kyriakos Mitsotakis says the safety of Greek citizens in the Middle East is the government’s top priority amid rising regional tensions, while also addressing the Tempi anniversary, major LNG energy agreements, railway reforms, and record tourism revenues.

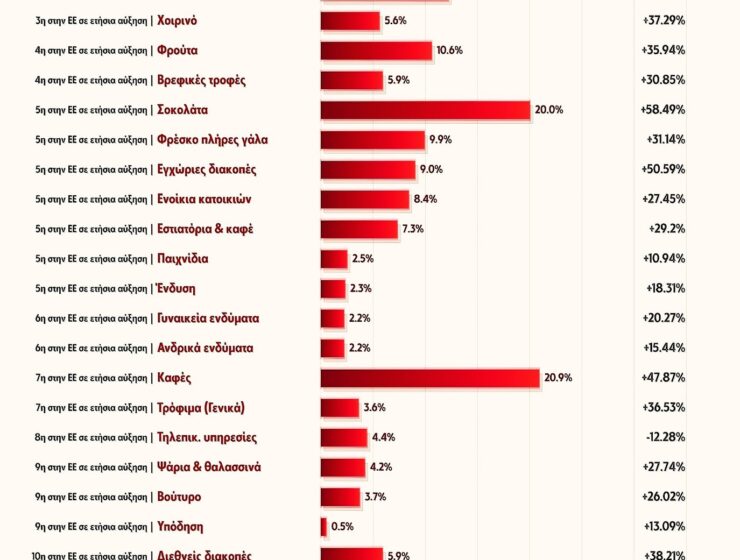

Greece ranked among the highest in the European Union for annual price increases in December 2025, according to Eurostat, with sharp rises in meat, dairy, airfares, rents and holiday packages. The latest data also show steep cumulative increases since 2019, significantly impacting household purchasing power across the country.

Greek small and medium-sized enterprises (SMEs) are increasingly experimenting with artificial intelligence (AI), but few…

Greece gradually shifted over the last decade towards a more outward-looking production model, a new…

Greece announced it would return to markets with a 10-year bond reopening, as the Public…

International investors increased their presence in the Athens Stock Exchange in 2025, pushing foreign participation…

The Greek pharmaceutical industry is poised for growth as international trends reshape the sector. Over…

The average full-time salary in Greece’s private sector exceeded €1,500 in 2025, reaching €1,516, a…

Athens Stock Exchange is on the verge of joining the MSCI Developed Markets, marking a…

Greece closed the 2025 fiscal year with a primary surplus of €8.089 billion, significantly exceeding…

The Independent Authority for Public Revenue (AADE) conducted more than 68,400 tax inspections across Greece…

Greece is moving to overhaul its legal migration framework while maintaining a strict stance against…

Greek Prime Minister Kyriakos Mitsotakis said a meeting with Turkish President Recep Tayyip Erdogan is…

Piraeus Bank and the European Investment Bank (EIB) have signed an agreement to provide up…

Greece recorded a primary surplus of €8.006 billion in 2025, significantly exceeding the revised target…

Greece’s Independent Authority for Public Revenue (AADE) credited additional rent rebate payments totalling €1.37 million…

Greek taxpayers worked a total of 177 days for the state in 2025, two days…

The Thessaloniki–Skopje oil pipeline has officially resumed operations after remaining inactive for 13 years, marking…

Greek taxpayers who fail to cover at least 30% of their annual income through electronic…

The Greek Ministry of Development has extended the deadline for businesses to complete their registration…

Greece recorded economic growth rates in 2025 that were significantly higher than the eurozone average,…

An additional €8.9 million in rent refund payments was credited on Monday to the bank…

The volume of private construction activity in Greece increased by 5.3% in September, according to…

Almost 2.5 million drivers in Greece had not paid their vehicle circulation fees by Sunday…

The Greek government has announced a €250 million increase in the budget for the initiative…

Ongoing farmers’ blockades are costing the Greek economy up to €200 million per week, with Thessaly regions like Trikala and Magnesia suffering the most severe festive season losses amid restricted mobility, suppressed demand, and warnings of systemic risks from business leaders.

The total number of registered unemployed in Greece reached 894,065 in November 2025, according to…

Greece is taking another decisive step to strengthen the profile of its public debt, proceeding…