The HACCI National Federation met with Greece’s incoming Trade Commissioner in Sydney to discuss strengthening Greece-Australia trade ties, highlighting sectoral opportunities and collaboration. This event marks a key step in bilateral economic relations.

Finance

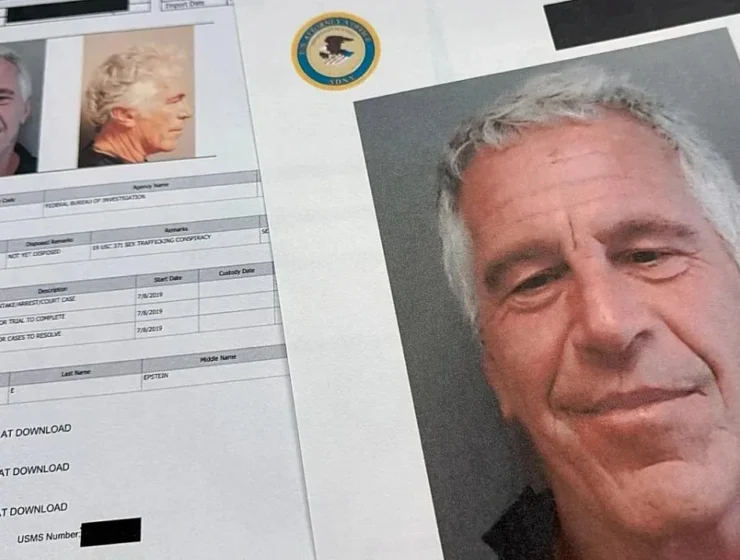

Newly released Jeffrey Epstein files reveal over 1,500 mentions of Greece, including a 2015 email to Noam Chomsky discussing the Greek bailouts as a mechanism to protect French and German banks rather than aid the Greek economy, describing the system as “strange accounting” and a “fiction.”

US Ambassador Kimberly Guilfoyle announced the historic first official visit to Greece by a sitting Federal Reserve Board Governor, Dr. Stephen Miran. “This marks the first time a sitting member of the Federal Reserve’s Board of Governors has come to Greece for an official visit – a milestone for our economic ties and financial engagement!”

Greece has prepaid €5.3 billion in 2010 bailout loans ahead of schedule, saving €1.6 billion in interest and paving the way for its debt-to-GDP ratio to fall below 120% by 2029 as part of an ambitious early repayment plan.

Greece at the heart of Wall Street! The @NYSE glowed blue & white tonight for the 21st Greek-American Issuer Day at the @CapitalLink Invest in Greece Forum — a proud celebration of the enduring U.S.-Greece bond and growing Greek presence on global markets.

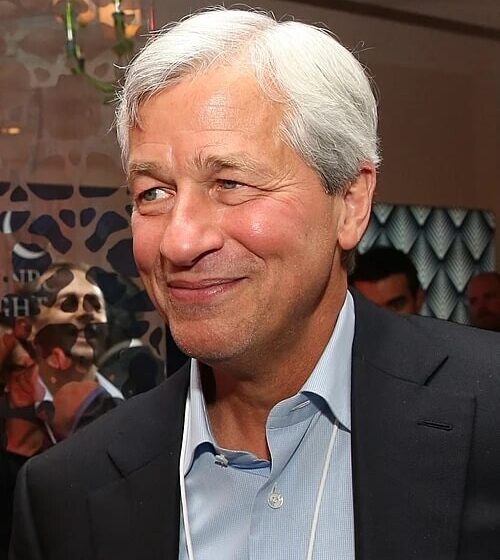

Greek-American JPMorgan CEO Jamie Dimon warns that Europe’s slow bureaucracy and declining economic strength pose a major risk to the US, urging a long-term strategy to strengthen the continent.

The Panhellenic Taxi Federation (POEITA) has announced a 48-hour nationwide strike on December 2 and 3, citing unresolved issues with the government and escalating pressure on the sector. The federation says key demands—including electric mobility extensions, fairer tax treatment, and stricter regulation of ride-hailing competition—remain unaddressed, and further mobilizations may follow.

Greek Minister Kyriakos Pierrakakis sues unknown Facebook page admins for using AI deepfakes to falsely promote high-yield investment scams.

Eurobank looks east, weighing the growth prospects of the Global South, while also utilizing the…

The head of the world’s largest bank has issued one of his most alarming forecasts yet, warning that investors are underestimating the risk of a severe stock market correction and suggesting the global financial system is heading towards a “once-in-a-generation reset.”

Moody’s reaffirmed Greece’s Baa3 rating with a stable outlook on September 19, 2025, citing sustained reforms, improved governance, and robust EU fund absorption. Despite a high debt-to-GDP ratio, favorable debt structure and liquidity bolster economic stability.

Canadian rating agency Morningstar DBRS has maintained Greece’s credit rating at BBB with a stable outlook, citing strong growth, steady debt reduction, and political commitment to fiscal discipline, while warning of external risks.

Greek singer Konstantinos Argyros has warned fans about fake profiles impersonating him on social media, urging them to trust only his verified Instagram and TikTok accounts after an online scam attempt.

Two Cypriot shipping companies, Interorient Navigation and Danship and Partners, will invest 10 million rupees…

Euronext is in talks to acquire up to 100% of Athens Stock Exchange (ATHEX) shares, valued at €399 million, through a share exchange offer of €6.90 per share. The potential deal aims to integrate Greek markets into Euronext’s network, enhancing EU capital market competitiveness.

The Independent Authority for Public Revenue (AADE) has released lists of 11,616 individuals and 18,762 legal entities owing over €150,000 in unpaid debts to the State and e-EFKA as of June 24, 2025. Top debtors include Acropolis Securities (€14.4B) and Kosta Chris (€1.127B). Published for transparency, the data reflects debts unpaid for over a year.

What does it really take to retire to a Greek island? Lynn Roulo, who made the move to Athens over a decade ago, shares six islands that don’t just look the part, they work for real life too.

United Media Sarl, the media arm of the Southeast European telecoms conglomerate United Group, has officially acquired a 50% equity stake in Alpha TV.

Athens hoteliers are reporting an unexpected boom, as hundreds of Israeli tourists temporarily stranded due to disrupted travel routes extend their stay.

Greece has solidified its position as the top European importer of Iraqi oil in 2024, according to data from S&P Global Commodity Insights.

Greece’s Golden Visa program sees a 28.5% drop in applications in April 2025, the first decline since 2022, despite a surge in property purchases driven by earlier investment threshold changes.

The European Central Bank (ECB) announced a 25-basis-point cut to its key interest rates, reducing the deposit facility rate to 2 percent, with rates for main refinancing operations and marginal lending facility lowered to 2.15 percent and 2.4 percent, respectively, while revising its inflation forecast downward.

Standard & Poor’s endorses Greece’s plan to repay first bailout loans early, projecting no impact on the country’s credit rating. The agency hints at a potential economic upgrade, citing improved external imbalances and a positive outlook for Greek banks, despite concerns over household debt.

Jamie Dimon, CEO of JPMorgan Chase, warned at the Reagan National Economic Forum that excessive U.S. government spending and the Federal Reserve’s loose monetary policies are pushing the bond market toward a crisis. Describing it as a “looming fracture,” he said the collapse could occur in six months or six years but is inevitable, urging investors to prepare despite recent market resilience.

A multimillion-euro EU subsidy fraud scandal has rocked Greece, with the European Public Prosecutor’s Office investigating fraudulent agricultural claims centered on Crete. Over €2.9 million was siphoned through fake land declarations, exposing systemic oversight failures at Greece’s Payment Authority (OPEKEPE). The probe, targeting a suspected organized network, has led to criminal proceedings against 100 individuals, raising urgent questions about transparency and accountability in EU fund management.

Fitch Ratings upgraded Greece’s credit outlook to positive, affirming its ’BBB-’ rating, driven by a 2024 budget surplus of 1.3% of GDP, a sharp decline in public debt to 154% of GDP, and resilient 2.3% economic growth.

The EU is unleashing AI-powered “robot tax cops” to tackle €90 billion in annual VAT fraud. Already successful in countries like Malta and Italy, the new system will use advanced algorithms to detect scams and recover lost revenue, marking a high-tech crackdown on cross-border tax evasion.

Attica property owners bear 53% of Greece’s €2.3 billion ENFIA tax, despite representing only a third of property owners. Greece’s real estate has an objective value of €777.8 billion, with commercial values exceeding €1.1 trillion, driven by a 30% price surge since January 2022.

Greece plans to repay its first bailout loans by 2031—ten years early—easing future debt pressures and highlighting its strong fiscal rebound, Finance Minister Kyriakos Pierrakakis announced.

Greek shipowners face new US port fees on China-built vessels starting mid-October, as announced by the USTR. Aimed at boosting American shipbuilding, the fees will also affect LNG transport and increase over time, impacting a significant portion of Greece’s fleet.